Occam's Roadmap and FAQ

Cardano has long been considered one of the most promising blockchains because of its potential for growth. And that potential is starting to come to fruition, transforming the communities collective vision into a reality. Through Occam, we can help the Cardano ecosystem grow, enhancing its DeFi capabilities.

As the momentum and interest in our technology is growing, we are excited to share with our community our products and roadmap with a greater level of detail. Bringing deep levels of liquidity from other blockchains is no simple task, but we will aim to achieve it at an accelerated pace and with unparalleled quality.

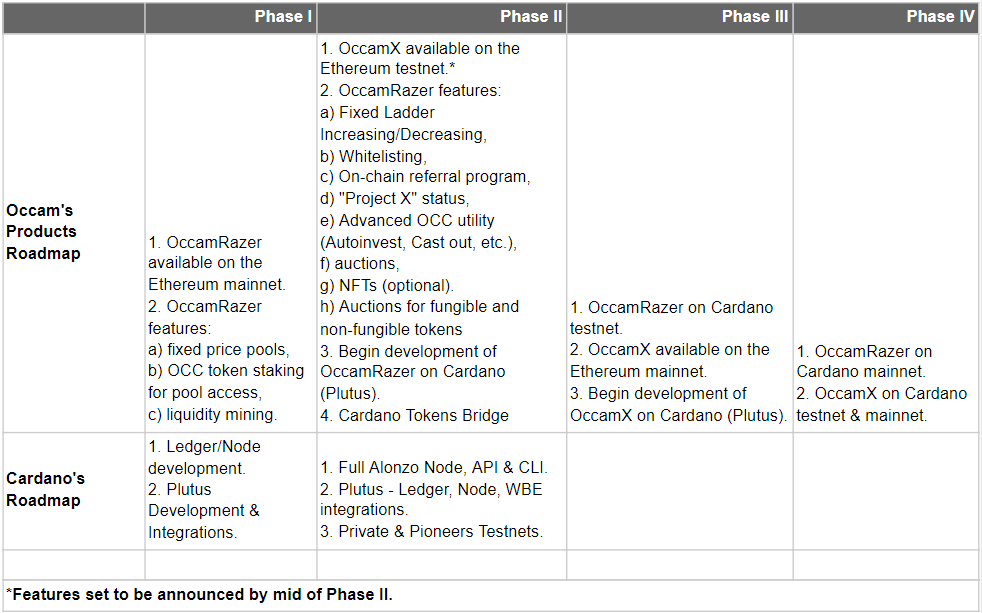

Product Roadmap

In order to make the experience of incorporating all the moving pieces of the ecosystem as seamless and convenient for projects/users/community as possible, we have carefully developed a roadmap that will slowly incorporate all the building blocks and ultimately provide the new Cardano liquidity exponentiated ecosystem.

Phase I

During the first Phase, we plan to release OccamRazer on the Ethereum mainnet with its core features - fixed price pools, OCC token staking for pool access, and liquidity mining. We began working on Phase I and Phase II deliverables almost 8 months ago.

Phase II

Throughout the second Phase, our intent is to release the full set of features for OccamRazer, enabling a much more flexible fundraising process as well as deeper integration of the OCC token’s utility, we also expect to release OccamX on the Ethereum testnet during this time.

According to Cardano’s roadmap a testnet with smart contracts should become available in this Phase, which will allow us to begin the development of OccamRazer on Cardano. In parallel, we will collaborate with our business partners (centralized exchanges and wallets) towards building a Cardano-Ethereum bridge which will allow anyone to deposit, trade, and withdraw OCC as either Ethereum and Cardano native token.

Phase III

While we believe that OccamRazer will be launched on the Cardano testnet in Q2 2021, we want to reserve sufficient room for development as we will have to code from scratch the entire smart contract codebase in Haskell. OccamX should be launched on the Ethereum mainnet and development on Cardano is to follow.

Phase IV

In this phase, we expect to deploy to the Cardano mainnet both OccamX and OccamRazer.

FAQ

Introduction

Is OccamRazer the only product released by Occam.fi?

As we previously presented in our Medium article, OccamRazer is not a unique platform, but part of a larger ecosystem. This ecosystem will have 3 main components:

OccamRazer: The next-generation protocol for decentralized fundraising. OccamRazer enables projects to raise funds, and in time we hope it will attract some of the most diverse projects in the blockchain ecosystem.

OccamX: A competitive and efficient DEX, filled with both industry-standard and unique capabilities. OccamX will provide the next building blocks to accompany the primary markets built on OccamRazer.

OccamDAO: Finally, our governance layer, together with the OCC token at its core, will govern how the ecosystem behaves. A decentralized autonomous entity controlled by the community, OccamDAO will be equipped with several opportunities for the ecosystem to leverage the power of our community.

What is OccamRazer's motivation?

At Occam.fi we are passionate about expanding the benefits of blockchain technology throughout the world. Blockchain’s applications for decentralized finance are changing value as we know it. But we have found that something is missing. Hundreds of blockchains, thousands of protocols, and millions of users still deserve robust and efficient DeFi infrastructure, especially for the rapidly growing Cardano ecosystem. That's where we come in.

Why Cardano?

With several established blockchains, it’s a natural concern not knowing which one to choose when developing the next generation decentralized fundraising protocol. The classic Blockchain Trilemma that faces scalability, security and decentralization cannot be taken lightly. But we are confident to have found an elegant blend of these three factors in Cardano.

Cardano is among the most promising blockchains, and is the only peer-reviewed layer-1 solution, built with flexibility in mind. Cardano also has one of the largest, strongest, oldest and most intelligent communities (>1m users across its vivid social platforms). Having one of the largest token holder bases, and with over 16 billion ADA tokens idle waiting to be of use, Cardano provides a unique opportunity to develop the next boundless decentralized ecosystem.

It is a synergistic relationship; the launchpad will leverage on the unique characteristics of Cardano, providing the stepping stone for its unparalleled DApp ecosystem. OccamRazer will enable projects to raise funds by providing many types of unique fundraising mechanisms.

Who will benefit from the platform?

Of course, a protocol built on Cardano should only benefit the Cardano community, right? Well, while it is true that the Cardano community will have the most to gain, other ecosystems will also be able to participate. For example, Ethereum holders cannot currently allocate their capital to new and exciting projects being built on other chains, specifically Cardano, but through a cross-chain bridge, they finally can.

As we previously mentioned, the size and idle liquidity of Cardano will also see the ecosystem explode after the introduction of DeFi liquidity solutions..

That’s not the full extent of it, either. Because of a short-term constraint on the deployment on Cardano, we will initially launch the OCC token as an ERC-20 token in Ethereum. Additionally, with the launch of our Bridge, we will be able to funnel Ethereum's liquidity, benefitting users around the globe, and allowing Ethereum users to get exposure on Cardano’s projects in a seamless and trustless manner.

What is an ‘IDO’ and why is OccamRazer using ‘IDOs’?

An IDO is an acronym for Initial DEX Offering. It means that the sale of newly launched tokens is done via a decentralized mechanism which ensures transparency and equal access opportunities.

The IDO mechanism enables a myriad of benefits, such as previously mentioned transparency and equal access, but also programmability of the IDO conditions—such as maximum allocation per user, time period of the fundraising process, terms of IDO termination etc.

That is why Occam.fi is using the IDO mechanism to raise funds for cutting-edge projects. It ensures that both the users and the team performing the fundraising get the most benefits all the while using a much more efficient system.

OCC Listing

Has Occam.fi listed anywhere yet?

After a successful public IDO, we funded a Uniswap pool. The trading pair is ETH-OCC, and the current address, price and volume can be found here, among other CEX (Centralized Exchanges) listings:

https://www.coingecko.com/en/coins/occamfi#markets

Information on new listings will be released on our socials, specifically Twitter and Telegram. Become a part of our community and follow us on social media!

How do you buy the OCC token and which tokens do you need to deposit in order to get OCC?

After the conclusion of our public IDO, we are now listed on Uniswap and a number of other secondary market trading venues. You can find our Uniswap address here:

The OCC token is also included in digital asset tracking and ranking websites, such as CoinMarketCap and Coin Gecko.

As and when the OCC token is added to other exchanges, these changes will be reflected on the aforementioned sites. We will also announce high-profile listings via our social media channels. Be sure to follow us on our Twitter and Telegram groups.

OCC token is available for exchange with multiple digital assets such as ETH, USDT, and more.

The Ecosystem

What are Continuous Ecosystem Diversification (CED) rewards?

Continuous Ecosystem Diversification (CED) is a unique rewards system that OCC token stakers gain access to when they stake more than 150 OCC tokens and less than 4000 OCC tokens for the required time period before an IDO begins. CED rewards are distributed as tokens of the projects which launch through an IDO on OccamRazer. As long as an OCC token staker has staked more than 150 OCC tokens for the required time, CED rewards will be distributed to the user for every IDO that has green CED mark on IDO card launched on the OccamRazer launchpad. The period between an IDO and CED rewards distribution of tokens may vary.

CED rewards are distributed on a pro-rata basis according to a user’s OCC stake. Simply put, the more OCC you stake, the greater the portion of the tokens available as CED rewards you will get. The total amount of tokens that are distributed to OCC token stakers through CED rewards does not solely depend on Occam.fi's CED reward fund. Each project can decide if they will voluntarily supply more tokens for the CED rewards.

Finally, to clarify, CED is not it's own token—you will get tokens from the projects launching IDOs on OccamRazer—through CED rewards.

How do CED rewards work exactly?

Let’s say a project called “CardanoStartup” launches through an IDO on OccamRazer. Their token is called CSUP. They launch their IDO on OccamRazer, and 20,000 of their CSUP tokens are purchased by the Occam Association during the IDO—for the purpose of distributing them as CED rewards.

Once CardanoStartup’s IDO ends, everyone with more than 150 OCC staked will get a CED reward paid in CSUP around two weeks after the IDO ends, as long as they had their OCC staked before the deadline—usually at least 7 days before the IDO begins. The 7 day deadline is the default deadline, however this deadline may vary, and can be changed by the project’s dev team.

The distribution of the 20,000 CSUP is done pro-rata. This means that a user that has staked 1000 OCC will receive twice the CED rewards than a user that has staked 500 OCC.

Even if users who stake more than 150 OCC before the deadline do not participate in the CardanoStartup IDO, they will still receive CED rewards.

If a pool requires KYC to participate, the CED rewards will still be distributed to those staking more than 150 OCC even if they do not pass KYC. These rewards will be available to claim around 2 weeks after the end of the IDO. Rewards are visible and claimable via the OccamRazer tab.

CED isn't related to guaranteed access to an IDO pool—however, if you have at least 150 OCC staked for CED rewards, this also counts towards the amount of OCC stake required to participate in an IDO pool. Naturally, CED rewards are only available after an IDO has concluded, so there are no CED rewards available before an IDO starts.

Your estimated CED rewards will be shown natively in the OccamRazer launchpad alongside project’s announced IDOs, this will let you calculate the value of your rewards.

You can claim your CED rewards at any time after the IDO has concluded and the two week waiting period has elapsed, this means you can wait until there is a cost-effective time when gas fees are low. CED rewards from multiple IDOs can be claimed in a single transaction if a user chooses. You may hold, trade, or sell any tokens received through CED.

CED is a totally new and novel token mechanism that essentially rewards long-term staking participants with a steady stream of IDO project tokens, as long as they continue to stake over 150 OCC in the set time before the IDO starts. We are very excited about the long-term economic rewards of this feature.

What is the deadline to stake OCC—in order to receive CED rewards?

The deadline is generally 7 days before an IDO starts. However, this is the default setting. This parameter may be changed by the project’s dev team or the Occam.fi team upon creation of the IDO pool.

How will the platform facilitate both Ethereum and Cardano-based exchange?

The Ethereum <> Cardano Bi-directional Bridge is now Live! Our Medium article does a great job in laying-out the characteristics of our Ethereum <> Cardano bridge. You can read more about this feature here.

When is Occam.fi launching its first components?

The first component of the Occam.fi ecosystem, OccamRazer, was launched on 14 April 2021. Our Ethereum <> Cardano liquidity bridge has been released and it is powered by the Bitcoin.com Exchange and our proprietary software. To use our Ethereum-Cardano bridge, click here.

More features will roll out in accordance with our product roadmap phases. Please see our product and technical roadmap for more insight into our scope and delivery timelines.

Be sure to connect with us through our social media channels to get the latest updates on our product releases!

Will OccamRazer be open source? Will the smart contracts be formally verified?

We have already undergone a smart contract audit by ScalableSolutions and two audits by industry leading blockchain security firm, CertiK. CertiK audited our staking smart contract as well as our OccamRazer smart contracts. You can view and download CertiK audits here.

We believe transparency to be paramount, which is why we made the audits publicly available as soon as they were completed. As far as open-source is concerned, our codebase and components are currently proprietary, as our engineers have worked incredibly hard to build our platform, positioning us as a leading provider of liquidity and launchpad capabilities for the Cardano ecosystem.

Are you already incubating ADA projects?

Yes! If you are a successful Project Catalyst recipient or early-stage blockchain startup with a focus on the Cardano ecosystem, we would love to hear from you. Please reach out to us via our contact form on Occam.fi. Become a part of our community and follow us on social media!

How do I apply my project for an IDO?

To begin the process click here.

Will Occam.fi incentivize the community with rewards?

As you can read in this article, there are a number of mechanisms whereby OCC token holders can gain rewards and yields for holding OCC. We are also always exploring new ways to incentivize and engage our platform participants, and include those from the pre-existing Cardano community.

Please make sure to read our roadmap for more information on our development phases.

Is Occam.fi and Occam Finance the same group?

No.

Please be aware that there is currently a project called ‘Occam Finance’ on Twitter whom we have no affiliation with whatsoever. We will always refer to ourselves either as ‘Occam.fi’, ’OccamFi’; or, when relevant, to our specific components, such as ‘OccamRazer’, ‘OccamX’, or the ‘OCC Token’.

Any claimed relationship or superficial connection to ‘Occam Finance’ is categorically not endorsed by the Occam.fi team. We pride ourselves on being open and transparent and we will list our partners and channels where appropriate.

You may also occasionally read about the ‘Occam Association’. The Occam Association is a steering group and professional non-profit organization designed to oversee the fair use and growth of the Occam.fi ecosystem. As we grow, the Occam Association will explore DAO structures to facilitate community participation in Occam.fi’s governance. The Occam Association is to Occam.fi what the Cardano Foundation is to Cardano.

IDO pool types

OccamRazer allows projects to raise funds in a variety of ways. But while some of them are industry-standard, we are proud to have developed a number of ground-breaking, flexible mechanisms, designed to cater for the most diverse set of needs a project may have.

The primary differentiation of fundraising pools available on the OccamRazer platform are private and public pools. Public pools do not require KYC to participate nor do they have any other requirements such as staking OCC tokens. Private pools require the user wishing to participate in an IDO to complete the KYC process and also stake at least 150 OCC.

Fixed price mechanics: Fixed price swaps are a common way to minimize volatility and speculation/malicious activity through guaranteeing a specific price for an allocated supply.

Dynamic ascending or descending price mechanics. Though on one side of the coin the “Increasing ladder” is the most common fundraising type that incentives early participation, on the other side it discourages late participation, and has historically been used for less-than-ethical projects. A theoretically similar approach is presented, the “Decreasing ladder”, that has more attractive properties and works better for less-hyped/undersubscribed projects.

IDO-type bonding curve fundraising. This type of curve has been a go-to model for DEX’s AMM like Uniswap. Taking into account token value, volume and supply, it algorithmically offers liquidity for every price based on a predetermined function. We provide multiple variations to sort the models’ inherent challenges such as pump-and-dump schemes and front-running.

Auction mechanics for projects with non-standard value propositions. Bi-directional auction swaps as well as Sealed-bid and Modified Vickrey Sealed-Bid auctions swaps are some of auction mechanisms that take into account several incentive structures from both bid-offer sides and that allow incentive coordination. Assuming sufficient information widely disseminated across participants, auctions promote more efficient resource distribution for illiquid projects with uncertain market value.

Front-running prevention measures and transaction mixing for privacy-valuing investors and sensitive deals. Average price-volume transaction processing as well as hidden transaction mechanisms aim to settle front-running practices inherent in the design of most public blockchain systems. This way, bigger players would no longer have the advantage over smaller ones who can’t afford excessive gas prices.

OCC on Cardano

Similarly to other assets on Cardano - e.g. ADA (with 6 decimal places, with the subunits being Lovelace), the OCC token issued on Cardano also has 6 decimal places, otherwise one would need to buy/sell or transfer OCC in multiples of an entire OCC token which, of course, is far from practical and much less convenient.

In contrast, the OCC token issued on Ethereum has 18 decimal places (like Ether and wei - one Ether = 10^18 wei). While we considered 18 decimal places for the OCC token on Cardano (in order to mirror the behavior of the Ethereum-based OCC token), we have determined that this, at the moment, is not practically possible for our case as the maximum possible amount of a native token on Cardano is 9,223,372,036,854,775,807 (learn more here).

Anyone can be confident that the amount of issued OCC tokens on Cardano is 100,000,000 (one hundred million) and the conversion will be 10^18 smallest units (on Ethereum) equaling to 10^6 smallest units on Cardano. Cardanoscan OCCADA address

On Ethereum the "decimals" information is saved in a variable of the token contract, which is used by the wallets and other blockchain explorers, in order to display the token amount correctly.

On Cardano this information is in the token registry, which Cardano Foundation teams have just approved. You can find it here:

In order to enhance user friendliness, we will append the "decimals" information there, and in this way Cardano wallets and blockchain explorers will be able to display the token amount correctly.

Tiers

What are tiers and what are the benefits of each tier?

The tiers for participation in Occam.fi launchpad are divided into five tiers. They serve the function of allocating appropriate benefits for appropriate OCC token staking amounts. Here is a comprehensive table with tier name, benefits, and requirements:

CED rewards are distributed to all users with over 150 OCC staked, regardless of the tier they are in. To read more about our tier structure visit this link.

Participation in IDOs

What is a project pool?

A pool is the smart contract that is deployed for an IDO. It stores tokens of a project which are to be sold and accepts user payments. It has some parameters such as start and end time, minimum contribution and maximum allocation for each user etc.

What is KYC?

KYC is an acronym for ‘Know Your Customer’. It is a process to ensure each participant is a real person, not a politically exposed person or a resident of a restricted jurisdiction, and that they comply with anti-money laundering requirements.

KYC is required for participation in private pool IDOs. However, it is not required for staking, receiving cast-out fees from ‘unstakers’, liquidity mining, receiving CED rewards, and participating in public IDO pools.

To begin the process of KYC—click this link.

Do I need to perform KYC for every IDO?

No. KYC needs to be performed only once.

Can anyone participate in an IDO?

Anyone can apply for public IDOs. Anyone can accumulate enough OCC to join a tier and participate in an IDO.

There are certain restricted As of May 15, 2021 the list of prohibited jurisdictions includes the following countries: Cambodia, Ghana, Afghanistan, Mauritius, Myanmar, Nicaragua, Pakistan, Senegal, Syrian Arab Republic, Yemen, Iran, North Korea, United States of America (except accredited investors), United States Minor Outlying Islands (except accredited investors).

The difference between private and public IDO pools

The difference is simple and straightforward. Users do not need to stake any OCC or perform the KYC process to participate in a public IDO pool.

The user, however, has to stake at least 150 OCC and perform the KYC process to potentially participate in a private IDO pool. For each IDO it will be stated whether it is a public or a private pool.

What are possible pool states?

If you see the ‘In progress’ state, that means this pool is open for participation.

The state ‘Sold out’ means the pool was bought in full before the expiration date and it shows extraordinary interest in the project. Participants are welcome to claim the project tokens they bought.

The state ‘Finished’ means that the project overcame the ‘Soft cap’ target and participants are welcome to claim tokens, which they bought during the IDO.

The state ‘Paused’ means we detected suspicious activity around the project and paused the pool. While the pool is paused, no interaction with the pool is allowed. That is an emergency operation.

The state ‘Failed’ means that the IDO pool failed, most likely due to the pool not meeting the ‘Soft cap’ target during the pool lifetime or because it was canceled by the Occam Association as an emergency response for malicious activity with the project or its tokens. In this case the funding by the OccamRazer users is refunded via the OccamRazer tab. The refund is equivalent to the funds sent by the user.

I sent the transaction and received an error, what does that mean?

Most likely that means that the pool is no longer available for buying, i.e. it is not in the ‘In progress’ state. That happens because other participants bought it in full before your transaction was accepted by the blockchain.

Another reason could be that the transaction was just denied by the blockchain, e.g. you didn’t pay enough gas fees for it to process correctly.

What is the minimum contribution?

Minimum contribution is the minimum order size you can send to a pool in order to buy tokens.

I bought tokens from the pool and the transaction was successful, but I don't have any tokens in my wallet. Is that correct?

Yes, it is correct, if the pool hasn’t finished. When you buy tokens in the pool you actually have these tokens reserved for you until the pool finishes. If the pool concludes successfully, you will be able to claim tokens you previously reserved. If it fails for some reason and no project token distribution takes place, your original funds are returned to you.

I bought some tokens in a pool and then changed my mind. Can I return my funds back?

No. These tokens you bought are reserved for you until the pool is finished. If the pool fails, then you can withdraw back your funds. But if it finishes successfully, then the only option available to you is claiming the tokens you bought previously.

Can I buy project tokens via multiple transactions?

Yes, but only from a single whitelisted wallet address. As long as the total amount of all the transactions does not exceed your maximum allocation which is designated by the tier you are in.

How do I claim tokens I purchased and what is the time-limit for doing so?

Once the pool time closes, either because it was fully subscribed or the time for fundraising has ended, you will be able to claim the tokens you bought by simply clicking on the 'Claim' button. This function will become available after some ~30 minutes has elapsed since pool completion, to allow project teams to set up secondary market liquidity pools.

Bear in mind that you can claim your tokens at any time, not only immediately after the pool has closed. Bought tokens will remain claimable indefinitely, secured by the smart contract until you are ready. This helps in allowing the user to better manage gas fees.

How do I verify token ownership?

Once the transaction is confirmed and the tokens have been claimed, on the Ethereum blockchain you should be able to see the respective amount of the project tokens in your wallet. If for some reason that is not the case, make sure that the transaction was successful and you have added the token, from the token list, to your wallet.

What is ‘whitelisting’?

Whitelisting is the process of enabling a specific wallet address, and by extension a user, to access a private pool IDO. A user that has staked over 4000 OCC and has passed the KYC process is considered automatically ‘whitelisted’ for all private IDO pools.

For users that have staked less than 4000 OCC and more than 150 OCC—they first need to register and pass the random draw mechanism—before they are ‘whitelisted’.

You can read more about the random draw mechanism in the sections below.

What is ‘guaranteed allocation’ and will the Occam.fi Launchpad (OccamRazer) have guaranteed whitelisting?

Guaranteed allocation means that a user is automatically ‘whitelisted’ for a private pool IDO. This means that the user can automatically participate in a private pool IDO—if the KYC and registration process is completed successfully and there was sufficient OCC staked by the user, for participation.

Guaranteed allocation depends on the tier a user is in, or in other words, it depends on the amount of OCC tokens a launchpad user has staked.

In short, all users that have staked less than 4000 OCC will have to pass a random draw system, while users that have staked more—do not.

How many OCC would need to be staked in order to access the launchpad?

In order to participate in a private liquidity pool, a user must stake at least 150 OCC. This however still does not guarantee whitelisting. In order to be automatically whitelisted—a user must stake at least 4000 OCC. To find out more about OCC staking thresholds and their benefits read the ‘Tiers’ section.

What is ‘maximum allocation’?

Maximum allocation represents the fiat-value of IDO tokens a user can purchase via the IDO. A Occamfi launchpad user’s maximum allocation depends solely on the tier they are in. The user’s belonging to a specific tier is determined by the amount of OCC tokens a user has staked.

What are IDO cool-offs?

An IDO cool off period is incurred by OccamRazer users in tiers Mont Blanc, Elbrus, and Fuji after they have participated in an IDO.

IDO cool offs signify the amount of IDOs a user has to ‘miss’—in order to participate in an IDO again. This amount varies from 1 to 2 IDOs—depending on the tier the user belongs to. The cool off period is ONLY incurred to the user upon successful whitelisting for an IDO—regardless of whether the user participates in the IDO. If you register, whitelist, but decide not to buy, you will still incur a cool-off period as essentially, you have ‘taken’ a spot in the IDO.

But you can still register and get the chance to participate even if you're on cool-off. Cooled-off addresses also get to participate in the final waves, so even if you're on cool-off, we still recommend you register for upcoming IDOs.

What are the ‘tickets’, ‘participation multiples’ and the ‘random draw mechanism’?

We sometimes use the term ‘tickets’ or ‘chances’. This represents the participation multiple with which the user enters the Occam.fi’s random draw system. Participation multiplies, or colloquially—’tickets’, affect the users chance to ‘win’ the ability to participate in an IDO.

Each user that is not in the K-2 and Mount Everest tier, must pass this random draw system. This system operates on a 100 % random basis.

Occam.fi users in Fuji tier have their stake weighted for participation multiples. This means a Fuji tier user with 1000 OCC staked receives 4 ‘tickets’, a user with 1250 OCC staked receives 5 ‘tickets’, and a user with 3850 OCC receives 15 ‘tickets’—which is the maximum number of tickets a user can have. The user in the Fuji tier does not have to stake 250 OCC tokens in increments to receive each ‘ticket’. This is calculated automatically upon the user’s entry into the random draw mechanism.

K-2 and Mount Everest tiers do not have participation multiples because they have guaranteed access to all IDOs!

When will Random Draw results be published for IDOs?

Results are published at least 24 hours before the IDO itself, or sooner. If you participated in the random draw selection, your status will be visible in your OccamRazer panel.

How long do I need to wait for KYC approval?

Once a user has completed the KYC process, a period of upto 24 hours will have to pass before the user gets KYC confirmed status. If the user has not received KYC confirmation after 24 hours, the best course of action is to contact the community managers via our Community Telegram group.

How do I know if I passed the KYC process?

If you passed the KYC process, when you connect your Metamask wallet, there will be a green icon next to the purple “Buy OCC” box found in the top right corner.

What are Rebate rewards?

Rebate rewards give a portion of OCC tokens to an individual upon participation in an IDO pool. Every IDO pool is assigned with its own individually selected amount of OCC tokens to be distributed as part of the Rebate Program.

The OCC rewarded through the Rebate Program is claimable through the OccamRazer panel. There is no time limit as to when a user can claim the Rebate Program rewards. The reward a user receives is calculated pro-rata, which means if a user fills 0.1 % of an IDO pool, the user will receive 0.1 % of that specific IDO pool Rebate Program OCC supply—which is individually assigned, in different amounts, to each IDO pool.

Keep in mind, to claim OCC tokens from the OccamRazer panel, the user will incur Ethereum gas fees, so it is best to claim the rewards once they have accumulated and when the blockchain congestion is low, however, that is not a requirement.

Rebate Ratio Claim Procedure

For those IDO pools which offer a Razer Rebate Reward, your pro-rata rewards percentage is paid in OCC. You will receive both the IDO project tokens and the OCC by clicking ‘Claim’ in the OccamRazer interface after the pool has concluded. The claim function will become available 1–2 hours after the IDO has concluded, this time is required for pool originators to deliver on post-IDO operational requirements.

Who Decides if IDO Projects are Delayed?

OccamRazer is a decentralized launchpad. We do not pressure, push, or hold projects accountable for delaying their IDO launch on OccamRazer. Timelines, token distribution, and launch are entirely dependent on the schedule of the IDO pool originator (‘the project’). We cannot accept liability for changes to IDO schedules, and we make every effort to update our community with the relevant information as soon as it becomes available to us.

OCC Tokenomics

Brief introduction

The OCC token acts as the fuel for the entire Occam.fi ecosystem which is composed of OccamRazer, OccamX and a single governance layer governed by a DAO. OCC will serve a number of functions, shaping agent interactions and setting good economic incentives for self-fulfilling growth of the value of the OccamRazer ecosystem.

This section gives a brief overview of the intended functionalities, defined in two separate categories: its core and auxiliary utilities.

Core Utility

Liquidity Mining: pool participants are rewarded with OCC token rewards, wherein the OCC tokens are gradually released from the Liquidity pool on a pro-rata volume-weighted basis.

Governance: OCC stakers will participate in the governance mechanisms via voting for the following types of proposals:

System upgrades.

Changes of system parameters.

Occam DAO investments.

The Governance mechanism will be implemented at a later date, keep up with our announcements to find out when!

Auxiliary Utility

Pool Access and Origination: The OccamRazer pool origination requires sending a small amount of OCC tokens to the Occam DAO for subsequent use in initiatives aimed at the growth of the ecosystem. Likewise, by default, private pools can only be accessed by stakers of OCC tokens.

Public and Restricted Pools: A pool can be set by the originator to be accessible only to stakers of OCC tokens. Enabling this feature provides a number of benefits:

The OccamRazer community will be notified by means of in-site alarms, and the placement of such pools on advantageous website spaces;

The Autoinvest functionality (see OccamRazer Autoinvest) will be activated for OCC stakers.

Referral Link: Creation of the referral link implies transferring some amount of OCC tokens to the DAO. These links will carry benefits for both, referrers and the users being referred in form of price discounts for buyers & traders, and rewards in quote assets or project tokens for link creators.

Cast Out: Unstaking of OCC tokens implies paying a small ‘cast out fee’ that is distributed on a pro-rata basis across the remaining OCC stakers.

OCC Raise: Verified OCC-nominated pools are subject to additional benefits.

Token Distribution

Distributed in % Initial Cliff Vesting

(OCC) Release (months) (months)

Seed Round 10,000,000 10% 10% 4 32

First round 10,000,000 10% 10% 4 8

Team 18,000,000 18% 2% 4 32

Liquidity mining 27,000,000 27% - - -

CED rewards system 12,000,000 12% 2% 2 12

Referral system 5,000,000 5% 5% 3 24

Marketing & Incentives 8,000,000 8% 10% 1 12

Token Liquidity 7,000,000 7% 100% - -

Advisors 3,000,000 3% 10% 4 8

Where are the 7 million locked tokens held, and how long will they be locked for? What other token distributions do you have?

These tokens are held in a 'war chest' for the purposes of providing liquidity on trading venues other than Uniswap. There are many more exchanges we aim to list on, and each of them will require OCC tokens, as well as base assets such as ADA or ETH, to ensure a liquid automated market maker (AMM) pool; or a deep order book in the case of centralized exchanges.

Around 20.68% of our total supply was allocated to our early private and seed funding partners. These tokens are vested, meaning they cannot yet be sold on the open market, and they have been sent to Sablier for these participants to track their vesting schedule.

Why did Occam.fi start on Ethereum if Occam.fi is a Cardano-based project?

At present, smart contracts are expected to arrive on Cardano in Q4 2021. This means that had the Occam.fi team opted to wait for the smart contract implementation on Cardano, Occam.fi users would have missed months of staking rewards, CED rewards, liquidity mining benefits, and more.

The second primary reason is: the Occam.fi team has a focus on interoperability with a desire to connect the existing DeFi blockchains to get the best of all—and allow the free movement of liquidity from one blockchain to another. There is also the beneficial factor of being part of the first mover IDO platforms—which enabled us to start building our supportive community as soon as possible!

There is no question whether or not the Occam.fi team has a focus on Cardano—and this is proved by the fact that the Occam.fi developer team is part of the Plutus Pioneer Program, our Occelerator incubator, and more.

What is the Occam.fi Ethereum <> Cardano bi-directional liquidity bridge?

The Occam.fi Ethereum <> Cardano bi-directional liquidity bridge—is a bridge that enables digital assets, or in other words—tokens, to move from the Cardano blockchain to the Ethereum blockchain and vice-versa.

This is immensely important as it allows a single asset to utilize the benefits of both DeFi chains.

The Occam.fi bridge technology is proprietary and uses the centralised bridge paradigm, which means we are using an exchange partner as a bridge between OCC tokens issued on the Cardano blockchain—OCCADA, and the tokens issued on the Ethereum blockchain—OCC with ERC-20 standard.

The principle behind the bridge is simple—the total amount of OCC tokens existing on both blockchains is 200 million—double the amount of the initial, and the actual total supply of OCC tokens. This means only 100 million tokens are “unlocked” for usage. To clarify with an example, when an OCC-ERC20 token is moved from the Ethereum blockchain to the Cardano blockchain, the ERC-20 token is locked, and a OCCADA token is unlocked for usage on the Cardano blockchain.

Fo further clarify: there will never be more than 100 million tokens unlocked for usage, and the ratio of unlocked tokens between blockchains will vary as the users use the bridge to perform the transition.

To read more about our bridge technology, click here.

What was the price paid by strategic partners for the OCC token? What is the price of the token that will be sold to the retail market?

The price that private strategic partners received ranged from 0.2 USDC to 1.1 USDC per OCC. We cannot confirm a specific token price on the broader market , given that it will be determined by supply and demand forces. Please, bear in mind that our early investors and strategic partners impart great value to our project through careful advice and consultation in the first phases of our launch.

Will the OCC token be available on Binance Smart Chain or only Ethereum?

Initially, the OCC token has been made available on the Ethereum network, with our main objective of making it available on Cardano as soon as possible. There are no plans to launch on or for BSC.

From where does the OCC token derive its value?

OCC token value is derived from its multiple use cases. The OCC token can be used to gain additional tokens via liquidity mining or the staking process which provides the staker with cast out fees from users that have unstaked their OCC tokens. The APY for liquidity mining at the moment of writing this section is over 100 % while the APY from cast out fees, at the moment of writing this section, is over 10 %.

A user can also gain additional project tokens from every IDO launch, if the user staked more than 150 OCC. The mechanism through which a user gains these rewards is called CED—continuous ecosystem diversification. The type of tokens with which the user is rewarded with—are the tokens which were generated and auctioned via the IDO.

Also, staking more than 150 OCC enables a user to participate in private IDO pools, or in other words, staking enables a user to participate in exclusive auctions of high-quality project’s tokens.

These are primary use cases, for now. They will only expand as the project further develops and matures.

These use cases, coupled with the constant growth of the Occam.fi ecosystem and user base imply the constant appreciation of the OCC token’s value.

The simple reason behind the constant appreciation is—as more users come into the Occam.fi Ecosystem and need the token for participation, with the supply slightly shrinking with time through the burning process for referrals and the non-existence of inflationary mechanisms—the token’s relative scarcity increases—increasing its value.

More information can be found here.

Capabilities and Our Team

Where can I find more information about the team?

The backbone of our protocol is our development team, a group of highly-capable, industry hardened scientists, engineers and programmers.

The rest of our team members and advisors are listed on the ‘About Us’ section of our website. You can also read more about our team here:

https://medium.com/occam-finance/meet-the-occam-fi-team-33bd12337bae

We are taking proactive steps to growing our team as we speak, so please check back periodically to see what new talent we have added to Occam.fi.

What is the best way to contact the team?

Our team can be contacted through our contact form on the Occam.fi website. Please visit Occam.fi, navigate to the burger menu on the right hand side, click the ‘Contact’ button, and fill out the form! We will aim to respond to all queries as soon as possible.

Please note - if you are a service provider pitching to Occam.fi, we are already receiving an incredibly high volume of requests and we cannot guarantee your proposal will be responded to if we are not currently interested in pursuing a working relationship with you. Our core focus at this time is bringing our components to market.

Why do we have strategic partnerships with Venture Capital groups, instead of raising through Project Catalyst?

Each companies' route to market is different. At Occam.fi, we chose to work closely with established venture capital partners to ensure that we have the expertise and funding in place to maximise our chances of early success. Due to the complexity and vision of the Occam.fi ecosystem, we required access to VCs with deep funding profiles to ensure we were well placed for success from our inception. We also began developing Occam.fi shortly before Project Catalyst Fund1 began, which wouldn't have provided the Occam.fi project with the funding it required to launch. VC partners take on a significant amount of risk by investing into early-stage projects. They also provide opportunities and insights that are instrumental to the launch of the Occam.fi platform.

OCC Staking FAQ

Can you stake OCC yet?

OCC staking is available through the Occam.fi ecosystem. To find out how to stake OCC please visit our tutorial here.

What are the benefits of staking?

Staking provides users with three different types of benefits.

The first is CED rewards, which have been explained in detail in the ‘OccamRazer platform FAQ’ and can be simply understood as an indirect way to receive tokens from each IDO.

The second benefit is direct access to the private fundraising IDO pools, with an allocated maximum participation limit. This limit is affected by the amount of staked OCC. More information can be found in the “Tiers” section.

The third benefit is cast out fee distribution to stakers which, at the moment of writing this section, averages around 10 % APY. More information regarding cast out fees can be found in the “Why is there a cast out fee section?”

Where can I stake?

You can stake by visiting: razer.occam.fi/personal/occ-panel/staking. Please see below for the supported staking wallets.

What wallet will I need for staking?

You can stake your OCC tokens from Metamask. We currently do not support other types of web 3.0 wallets. Ledger hardware wallet integration through Metamask is in progress. If you would prefer to use a Ledger wallet to stake, you may want to consider waiting until support becomes available, as otherwise you will need to unstake and incur a cast out fee.

Do I pay a fee to stake?

No. There is no fee paid in OCC to begin staking. You will pay a gas fee to interact with the staking smart contract on Ethereum, however. This fee entirely depends on the congestion of the Ethereum network at the time you stake.

How many OCC tokens do I need to stake?

You can stake any amount of the OCC token. Rewards are distributed on a pro-rata basis according to your total stake. The more you stake, the more rewards you receive. There is, however, a minimal amount of tokens one needs to stake to receive CED rewards and for private pool IDO access.

I want to add newly bought OCC tokens to my current stake, does this incur additional fees? Do I need to unstake and then stake again?

Fees in OCC are only applied when you remove stake from the staking smart contract. There is no fee in OCC to add extra stake to the staking smart contract. Please be aware that Ethereum gas fees will have to be paid each time you interact with the contract. For this reason, you may wish to wait until you have the final balance of OCC you wish to stake with before you start staking.

Why is there a cast out fee?

Our cast out fee has prompted some questions from the community which we feel are important to clear up. We asked you to vote on what the cast out fee should be, and it has now been set at 4%. The cast out fee was calculated on the 5th of May 2021 taking into account the weighted average of votes (4.38%) and rounded down to the nearest whole number. This information may help you to better understand its usefulness and process. Let’s discover what it means in simple terms.

Essentially, the cast out fee is a fee incurred to the unstaker which is the value of a small percentage of the total amount of OCC that is being unstaked. If you unstake 100 OCC from the staking smart contract, 4% of this will be the cast out fee. It is designed as a reward to those who continue to stake, and it’s an extra incentive within our OCC staking economics.

Some of our community have asked if the cast out fee is a penalty for removing OCC stake. The short answer is no. The only way that a staking participant would incur a loss through the cast out fee mechanism — is if they do not remain as a staking participant for long enough. Let’s look at a practical example.

Alice stakes 1,000 OCC through the OCC staking smart contract. She remains as a staking participant for three months, generating rewards from cast out economics and continuous ecosystem diversification (CED) from ProjectX IDOs. After three months, Alice decides to unstake her OCC. Alice will still pay 4% of her unstaked OCC as a cast out fee, but now Alice’s total staking rewards, owing to the dollar-value in rewards she received from other staker’s cast out fees and CED, far outweigh her own cast out fee.

As you can see, this incentivises long-term staking, but it does not cause a loss to staking participants who unstake, unless they do so after a significantly short amount of time. Instead, those who stake for a sufficient amount of time receive rewards that far outweigh the cast out fee.

In turn, long-term staking generally has advantageous effects on the market price of a token, effectively removing OCC from circulation and reducing its availability to be sold on exchanges — increasing demand and reducing supply.

Cast out fees will be distributed to remaining staking participants once enough cast out fees have been collected. They are then distributed according to participants' stake on a pro-rata basis of OCC/second.

Is OCC staking related to Uniswap liquidity mining?

No. These are two separate concepts. In Liquidity mining, OCC is provided to enable trading between other users, and a portion of the trading fees are awarded to the Liquidity Provider.

In staking, a user effectively locks his or her tokens into a smart contract. This smart contract then provides preprogrammed staking rewards such as CEDs and cast out fee distribution.

Keep in mind the user can ‘unlock’ his stake at any time and release the tokens from the staking smart contract - but in the process the user will be incurred with a stake out fee of 4 %.

Exact Staking Requirements — Read Me!

Important note — when you stake your tokens through Metamask, you will be prompted to approve access to your funds from the OccamRazer staking smart contract. You must accept this contract without modification in order for staking to be successful.

Guaranteed access to CED rewards: > 150 STAKED OCC, FOR A PERIOD OF AT LEAST 7 DAYS BEFORE IDO

You must stake for 7 days before the IDO begins—to be eligible for CED rewards. This staking period is the default setting, however, project devs can on their own discretion change the required staking duration.

If a staker accidentally or on purpose unstakes their stake, they are automatically no longer eligible for CED rewards of IDO pools that are to be launched within 7 days or less!

Restaking does not fix this consequence. If a user unstakes and restakes, the user will not receive CED rewards for the forthcoming IDO—if the IDO is in less than 7 days, but will receive CED rewards from any IDO pools that are to be launched in more than 7 days.

Claim functions for CED distributed tokens may take up to two weeks after the IDO has concluded. Gas will have to be paid to claim tokens, however tokens can be claimed at any time should users wish to minimise gas expenditure. If you stake 4000 OCC tokens or more, this qualifies you for both CED and guaranteed pool access. If you have staked between 150 and 4000 OCC you will first have to pass the random draw mechanism to participate in an IDO, however CED rewards will still be distributed to you.

Last updated